|

Getting your Trinity Audio player ready...

|

2024 is shaping up to be a promising year for those eyeing the Singapore property market. The scene is set for a more buyer-friendly environment, thanks largely to developers recalibrating their pricing strategies.

With market growth taking a more moderate pace and economic shifts continuing, developers are getting more in sync with what buyers are looking for, and can afford. This shift towards more realistic pricing that feels sensitive to the market’s pulse could be great news, especially if you’ve felt sidelined by high prices, or have been waiting for just the right time to jump into the residential property market.

During this phase, when the market is a bit more even-keeled, you as a buyer might find yourself holding a better set of cards. There’s a real chance to invest in properties at prices that are more sensible, reflecting true values. For those ready to negotiate, particularly in developments where re-sellers are eager to keep things moving, this could be your moment to strike a deal that feels just right.

Is Property a Wise Investment in 2024?

Heading into 2024, the Singapore property market outlook is riding a wave of ‘cautious optimism.’ This mood is shaped by a resilient market, despite some global economic wobbles and shifts in local policies.

| Read related article: Cautious Optimism for Private Property Prices in Singapore 2024 |

A few things are keeping the market steady in Singapore: a stable political scene, a solid legal system, and clear-cut property transactions. Sure, there are challenges like the global economic slowdown and higher home loan rates, but the strong job market and the government’s smart moves in managing housing supply are giving the market a boost.

For anyone looking to invest or buy a home in 2024, it’s all about smart navigation. The market’s being shifted by local factors as well as by big-picture global economics. It’s important to get the full view of these larger economic trends to make wise choices. You’ve got to think about how much property values might go up, but also keep an eye on loan costs, which can adjust with interest rate changes.

‘Affordability’ is the keyword here, focusing on staying financially healthy in the long run, rather than just looking for quick gains. Before diving into investments, take a hard look at how long you want to invest, your risk comfort levels, and your overall money health.

2024 is painting a complex scene for both buyers and sellers. If you’re buying, the timing might be just right to invest in a recalibrated Singapore property market following the past two years of shifts. For sellers, it’s time to tweak your game to match a market that’s finding a new balance. Whether you’re buying or selling, winning in 2024 means really getting the market’s rhythm and being ready to shift your strategies as required.

Upcoming Property Launches in 2024

This year, we’re looking at a range of new developments that are set to spice up Singapore’s property scene. From sleek and condos to innovative mixed use developments, there’s an opportunity to enter into the private residential market. These are not just buildings; they’re fresh, modern spaces designed for today’s lifestyles.

| Estimated Launch | New Condo Launch | Tenure | District | Location | Units | Developer |

| 1Q 2024 | 32 Gilstead | Freehold | 11 | Gilstead Road | 14 | Kheng Leong |

| 1Q 2024 | Marina View Residences | 99 | 1 | Marina View | 683 | IOI Properties Group |

| 1Q 2024 | Newport Residences | Freehold | 2 | 80 Anson Road | 246 | CDL |

| 1H 2024 | 21 Anderson (Former Royal Oak Residence) | Freehold | 10 | 21 Anderson Road | 18 | Kheng Leong |

| 1H 2024 | One Sophia (Former Peace Centre) | 99 | 9 | Sophia Road | 370 | CEL Development / Singhaiyi & KSH Holdings |

| 1H 2024 | Former Mount Emily Road | Freehold | 9 | 2,4,6 Mount Emily Road | 16 | ZACD Group |

| 1H 2024 | 33 Devonshire | Freehold | 10 | Devonshire Road | 21 | Sekon International |

| 2H 2024 | Former Kew Lodge | Freehold | 11 | 34 Kheam Hock Road | TBA | Aurum Land |

| 2H 2024 | Former Anson Centre | 99 | 2 | 51 Anson Road | 87 | Hong Leong Holdings |

| 2H 2024 | Former Robertson Walk | 99 | 9 | 11 Unity Street | 414 | Fraser Property |

| 2H 2024 | Former Valley Point | 999 | 10 | 491 River Valley Road | 622 | Fraser Property |

| 2H 2024 | Former Central Mall | Freehold | 1 | 20 Havelock Road | 370 | CDL |

| 2H 2024 | Former Caldecott Broadcast Centre | 99 | 11 | Andrew, Olive & John Road | 15 GCB | Perennial Holdings |

| 2H 2024 | One Leonie Residences | Freehold | 9 | 1 Leonie Hill Road | 37 | Far East Organization |

| 2H 2024 | Former Far East Shopping Centre | 999 | 9 | 545 Orchard Road | TBA | Bright Ruby Resource |

Keeping up-to-date with the ever-evolving Singapore property market outlook, our team of seasoned professionals at Singapore Luxury Homes (SLH) is on hand to offer personalised assistance in search of your dream home or eyeing a strategic investment opportunity. If any of these upcoming 2024 property launches have caught your eye, or if you’re interested in exploring more of what SLH has to offer, we’re here to guide you through your journey.

| Read related article: Our Top Picks of the Hottest New Condo Launches of 2024 |

A Balanced Perspective for Homebuyers of the Rental Market

As we peek into 2024, the rental market in Singapore presents a landscape of balanced opportunities, reflecting a more stabilised demand.

The number of new Employment Pass (EP) holders, which often influences the outlook for Singapore private property rental demand, experienced a modest increase of 5.34% or only 10,000 new EPs from December 2022 to June 2023. While not the sole factor, this uptick suggests a potential stabilisation in the rental market following a period of notable growth.

What does this mean for a buyer looking to purchase a property as a rental property investment?

If you’re looking to rent your newly purchased property, 2024 might offer a more relaxed market, with less competition for prime properties and potentially more negotiable rents. For new landlords, it’s about striking the right balance. Yes, the frenzied demand may be easing, but Singapore’s enduring appeal as a global business hub continues to attract foreign professionals, keeping the rental market active, albeit at a more sustainable pace.

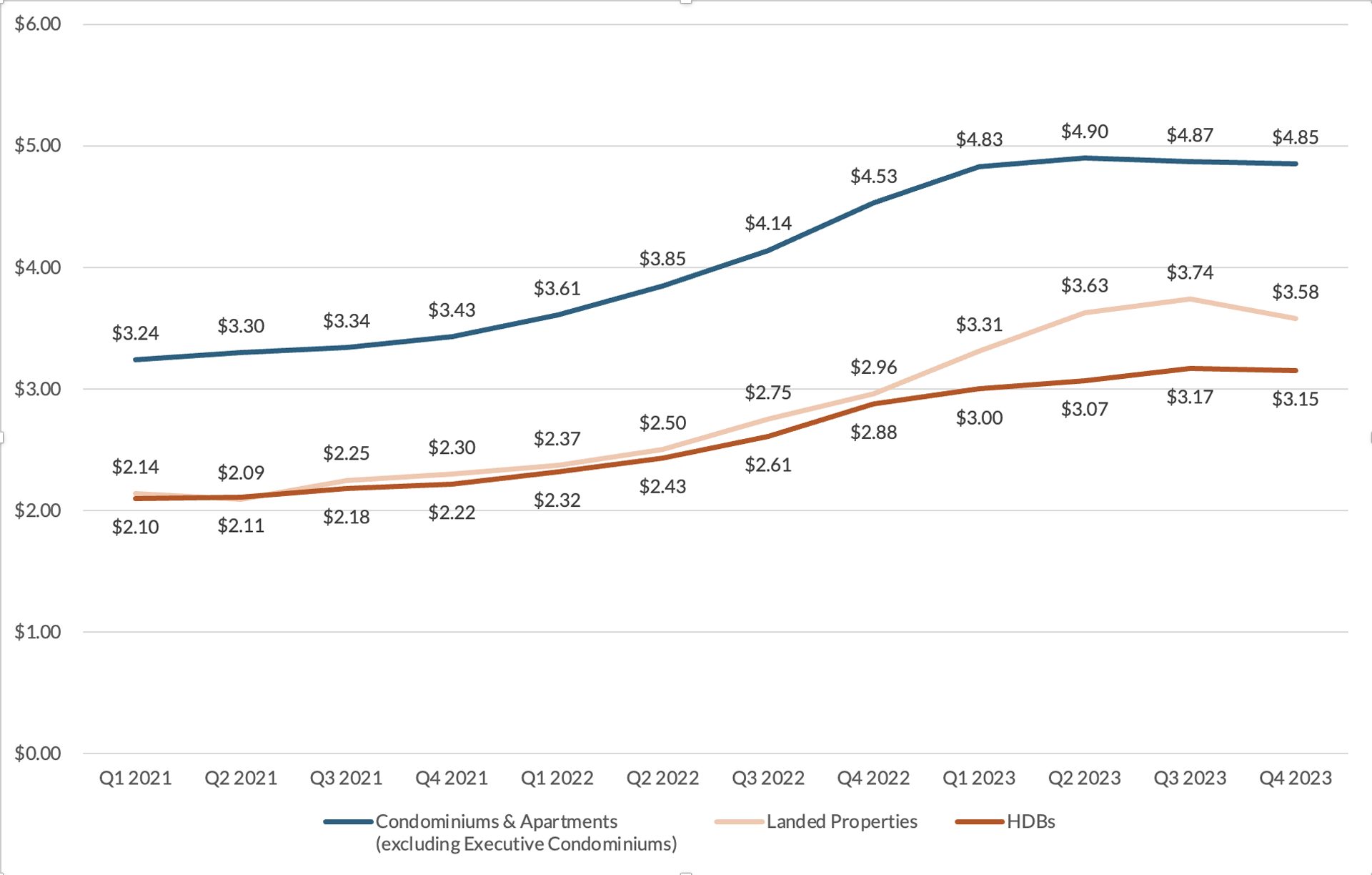

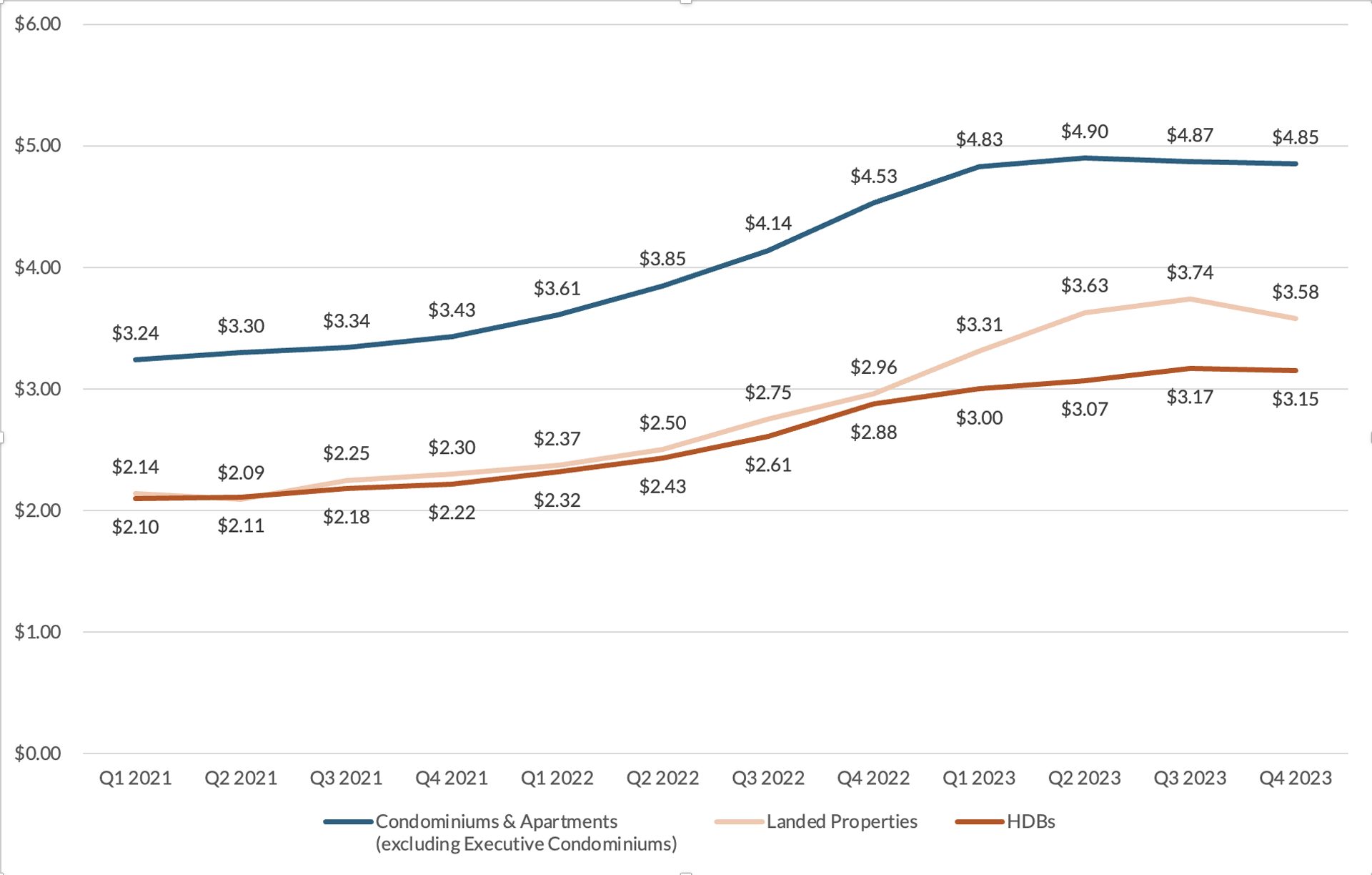

Rental Market Comparison Per Square Foot (psf) for Condominiums & Apartments, Landed Properties and HDBs by Quarter

Source: EdgeProp Market Trends rental price (psf) by quarter for Q1 2021 to Q4 2023

In this scenario, the spotlight is on properties that tick the right boxes – great location, attractive amenities, and competitive pricing. Landlords who adjust to these shifting dynamics, perhaps by sprucing up their properties, or being flexible with lease terms, could find themselves well-placed in a market that’s evolving with the times.

Singapore’s rental market seems set to unfold with a theme of equilibrium, promising a healthy interplay between supply and demand. For participants on both sides of the rental equation, understanding and adapting to this new rhythm will be key to making the most of the opportunities it brings for those looking to enter into the property market.

Your Questions Answered: FAQ about Navigating Singapore’s Property Market

Foreigners, including Americans, can buy private condominiums and apartments without needing government approval. However, buying landed properties and HDB flats is restricted and often requires specific eligibility or approval from the Singapore Land Authority.

Apart from the purchase price, buyers should budget for Additional Buyer’s Stamp Duty (ABSD), Buyer’s Stamp Duty (BSD), legal fees, and agent commissions. ABSD rates for foreigners are notably higher compared to local buyers.

Foreigners can obtain mortgages from Singapore banks, but loan-to-value ratios may be lower than for locals. Under FATCA, US citizens must report their overseas financial accounts, impacting the loan process and potentially influencing bank lending policies.

Yes, foreigners can rent out their purchased property in Singapore. Rental income is subject to taxation, and landlords must comply with legal requirements like tenancy agreements and upkeep standards.

New launches offer modern designs and potentially lower prices, but involve waiting for construction completion. Resale properties are immediately available and allow for physical inspection before purchase, but might require additional maintenance.

Rising interest rates increase borrowing costs, potentially reducing investment returns. Conversely, lower rates can decrease mortgage repayments, improving rental yield margins.

Recent cooling measures include higher ABSD rates and tighter loan-to-value limits to curb speculative buying and ensure market stability. These measures impact affordability and demand, especially for foreign investors.

Residential properties generally offer more stable returns and are easier to understand for new investors. Commercial properties can yield higher returns but come with higher risks and require more market knowledge.

Stay updated through real estate market reports, news from the Urban Redevelopment Authority (URA), financial news platforms, and subscribing to updates from real estate agencies.

Consider market timing, current property demand, potential capital gains taxes, and ways to enhance property value, such as renovations or upgrades, before selling. Understanding market trends and buyer preferences can also help in pricing your property appropriately.